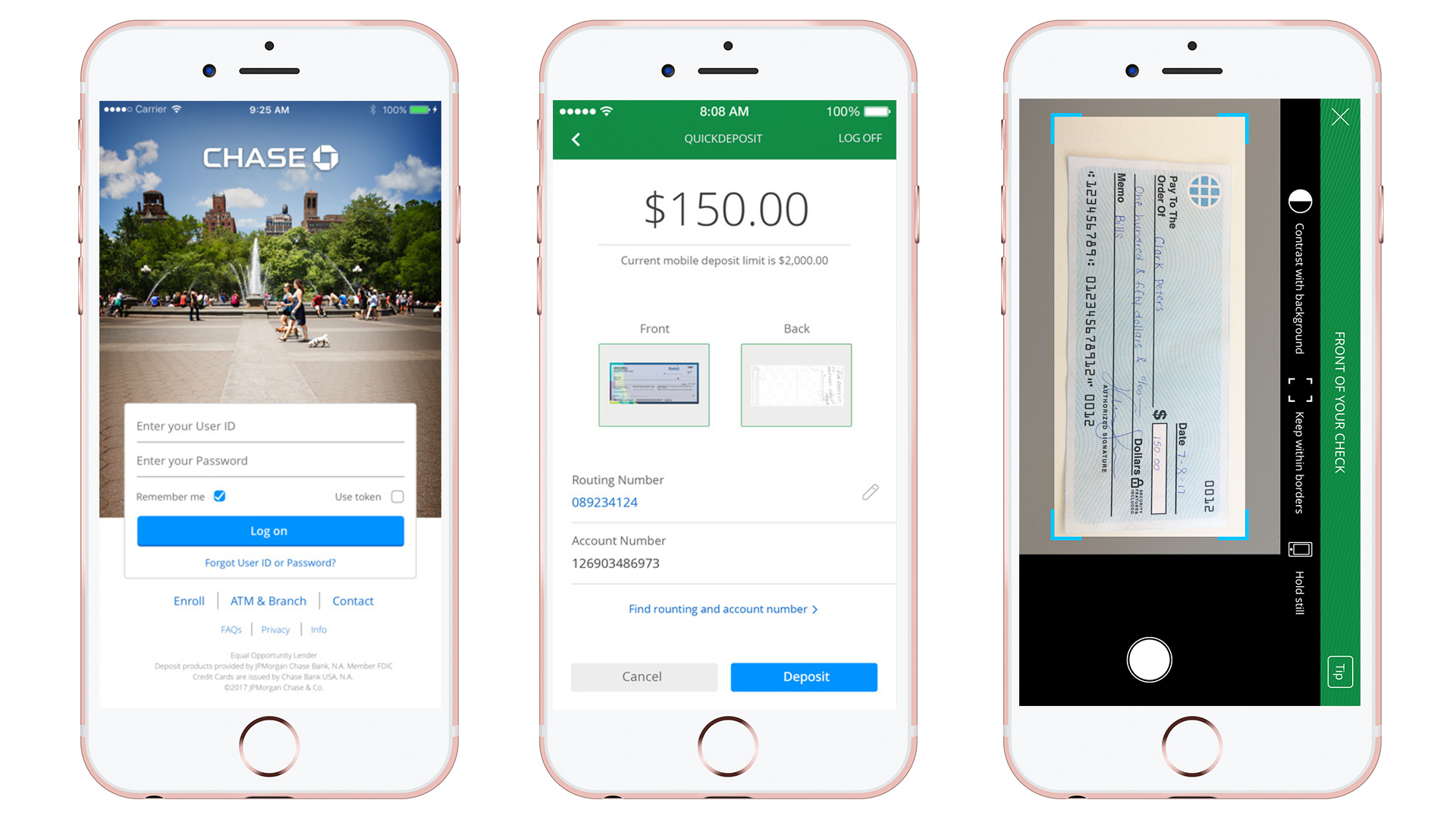

Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government. Person to Person payments (such as Chase QuickPay ® with Zelle ®) are not considered a direct deposit. After you have completed all the above requirements, we'll deposit the bonus in your new account within 15 days. A Traditional Financial Institution (TFI). does not usually post an early direct deposit of a tax refund. You might be wondering “how early” a direct deposit could be with these early direct deposit type of bank products. Below are prepaid products, credit unions, and traditional banks. Chase First Banking helps parents teach teens and kids about money by giving parents the controls they want and kids the freedom they need to learn. Learn about our checking services including direct deposit and to order checks. Open a checking account online. Student banking. Set up a direct deposit alert, so you’ll know when you receive your stimulus payment. When you set up your alert, make sure you choose the checking or savings account you expect the payment to be deposited to. Learn how to use Chase QuickDeposit℠ so you can deposit checks with your mobile phone or tablet from the Chase Mobile app. No, Chase First Banking does not have a direct deposit option. Chase High School Checking, an account for teens ages 13-17 that includes direct deposit and check writing, may be a better option. To learn more, visit Chase High School Checking SM.

The Chase bank direct deposit form is a standard and legal form that becomes effective once it is signed. The purpose of this form is to grant the necessary authorization for your Employer and Chase Bank to set up a Direct Deposit of funds into a Chase Bank Account of your choosing when it is time for the Employer to pay you. The rate and frequency of these Deposits will be strictly up to you and your Employer. Additionally, your Employer may also have their own procedures set in place to set up Direct Deposit Payments. Generally, it is expected that you will have a clear line of communication with your Employer regarding such matters before filling out and submitting this form to the Payroll Department in your place of employment.

Step 1 – Download the document from the button labeled “PDF” on the right side of this page. When you are ready, you may either open it to enter information or print it to enter information.

Step 2 – Read the information on the left side of the page then, when you are ready, report the Account Holder/Recipient Name on the blank line labeled “Customer Name.” Below this, use the “Address” line to enter the Chase Account Holder’s Street Address. On the next line, report the City, State, and Zip Code associated with the Chase Account Holder’s Street Address.

Step 3 – Next you must define the Type of Account you would like your compensation to be directly deposited to. If this will be a Checking Account, then mark the check box labeled “Checking Account Number” and enter your Account Number on the blank line above these words. If this is a Savings Account, then check the box labeled “Savings/MIA/Money Market Account Number” and enter your Account Number on the blank line just above these words. Only one of these boxes may be checked and the Account Number must be present on the blank line associated with that check box.

Step 4 – Report your Chase Bank Branch’s Routing Number on the blank line labeled “Bank’s Routing Number.” If you are unsure, you may find the Routing Number on your personal check. It is the nine digit number on the bottom left. Otherwise contact your branch directly for this number.

Step 5 – On the blank line in the statement beginning with the words “I authorize…,” enter the Name of the Employer or Paying Entity that you are allowing to make regular deposits into the Account defined in Step 3.

Step 6 – Sign your Name on the line labeled “Customer Signature” then, enter the Signing Date just above the word “Date.”

Step 7 – Submit this form to the Payroll Department in your Employer’s Company. Some Payroll Departments may require additional paperwork such as a blank voided check so make sure to contact them first regarding the procedure they have set in place.

Chase is one of the largest five banks in America. Yet despite its many customers from coast to coast, there are countless bank clients who do not know how long the Chase direct deposit times are. Keep reading to learn all about direct deposit with Chase Bank, including the amount of time it takes to have one credited to your account.

What Does Direct Deposit Involve?

Direct deposit is the process of havingmoney digitally deposited on a certain date into your bank account. This couldbe done by a government agency, employer, or other third party. The benefit ofdirect deposit is that it gets rid of the need for paper checks and having togo deposit them physically in the bank. After the funds are credited to yourbank account, you can access them immediately.

It is not difficult to establish a directdeposit. You must enroll through your payer or employer. To do so, you fill ina direct deposit form. The form requires that you provide important informationlike your bank routing number, bank name and address, and your account number.Sometimes they will require that you give them a voided check to complete theprocess.

Times for Direct Deposits Vary Per the Bankor Credit Union

Many customers want to know how soon theycan anticipate the funds hitting their account. Would it be available atmidnight? The time for direct deposit does not depend on the major payroll companiessuch as ADP. They disburse the funds to the various financial institutions aspart of the process. It is up to the individual bank like Chase as to when thefunds get posted to your account. Our staff contacted Chase to learn theprecise time frame for receiving the direct deposit into your bank account.

Direct Deposit Times at Chase Bank

When will you receive credit for the directdeposit at Chase Bank? Our researcher’s discussion with the financialinstitution revealed that they post the direct deposits between 3am and 5am(EST). You can learn more information about direct deposits at Chase Bank bygoing over to their website, through calling them, or stopping by a nearbybranch in person.

What Benefits Do You Gain from DirectDeposit?

There are a number of advantages to havingdirect deposit set up, including the following:

Chase Direct Deposit Form Without Voided Check

- You avoid frequent trips to deposit your payroll at the bank.

- You no longer need to worry about having your paycheck damaged, stolen, or lost.

- You are not required to wait on your payroll check in the mail or to go pick it up at work.

- You get the benefit of direct access to your cash once it is posted to the account.

- You can direct where your paycheck is deposited and have the funds deposited into several different accounts if you like.

In Conclusion

Direct deposit offers you so manyadvantages over traditional check depositing. You gain the security and safetyit features along with convenience and immediate access to funds. Chase makesit a point to put the money in your account from 3am to 5am on the day itarrives, before you even get up for breakfast. It does not get more convenientthan that.

Chase Direct Deposit